建議您使用以下瀏覽器觀看合一網站,

以獲得最佳瀏覽效果。

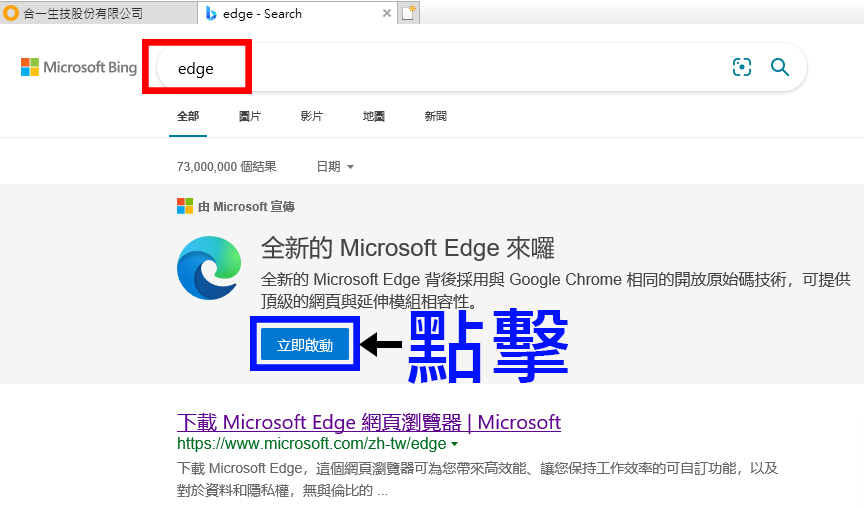

如何使用IE找到Microsoft Edge?

-

開啟新分頁(紅色框)

-

於搜尋框中打入Edge(紅色框),並按搜尋(藍色框)

-

點擊【立即啟動】(藍框處)打開 Microsoft Edge

What is the company’s viewpoint on the market size of Fespixon (ON101) after it gets the NHI drug price?

Due to the lack of effective drugs for DFU, the current treatment only uses the dressings for wound care, or depends on the surgical skills of doctors. The burden of DFU treatment on the national health insurance has exceeded NT$10 billion. ON101 is the only approved DFU drug in Taiwan at present. It has been proved to have significant efficacy in Phase III clinical trials and has a clear drug mechanism. After being included in the National Health Insurance System, ON101 will have an opportunity to monopolize the market.

For Fespixon determined by U.S. FDA to be applicable to regulations of medical devices, does it refer to the current cream type? If it is marketed in the form of medical devices at a lower price, can it be on the market in the form of more profitable drugs later?

1. Yes.

2. The purpose of applying as medical devices is to enter the market early; Fespixon (ON101) has started the U.S. new drug Phase III trials, and if all goes well, the time to market is expected to be in 2024, while the time approved to market for medical devices may be in the Q2 of 2022. The future market price will be fairly with the drug price (not priced yet), and Oneness Biotech can use this time to deploy the market early. The sale of medical devices will be stopped when the new drug is on the market.

Regarding the sales of Fespixon in the domestic market, is the current cooperative mode with pharmacies marketing channel buyout or consignment management? Is the time of revenue recognition the delivery time of the drug to the pharmacies, or the buying time of consumers?

The outright sale is adopted for Fespixon. According to IFRS 15 “Revenue from Contracts with Customers”, the sales revenue is recognized at the time of shipment. Meanwhile, the possibility of customer returns will be individually assessed based on experience and the refund liabilities will be reported.

Has your company conducted a market survey on the approximate number of DFU patients in Japan?

According to the Japanese laws and regulations, should the clinical trial be carried out all over again (like it is in the United States) if you want to apply for a drug permit license (on Fespixon) and gain access to the Japanese market?

Does the company have any further strategies for viewing and planning the Japanese market?

1. According to IDF statistics, the number of diabetes patients in Japan is approximately 7.39 million. As to the Diabetes Research and Clinical Practice 2018, the prevalence of DFU is only 0.3% which makes about 22,000 patients with DFU in Japan.

2. Yes. Clinical trials must be conducted on the trial subjects of the Japanese race before gaining access to the Japanese market.

3. In conclusion, due to the low number of DFU patients in Japan and the high number of requirements for market access, it is currently not the main target market.

What are the estimated sales of Fespixon after launched for sale in Taiwan? How many DFU patients are there in Taiwan?

1. Though unable to provide an accurate account of the sales forecast, we are able to give a specific explanation of the current market conditions. At present, Fespixon is the only new drug approved in Taiwan for the treatment of diabetic foot ulcers (DFU), with a significant treatment effect and a clear mechanism of action proven by the Phase III clinical trial. Currently, there are only medical devices generally used as dressings for wound care, or relying on the surgical treatment of physicians. Therefore, we are very confident about the future prospects of Fespixon in the market of Taiwan.

2. There are currently about 70,000 DFU patients in Taiwan.

After hitting the market, what is the estimated market penetration of FB825 compared to that of Dupixent?

After hitting the market, the drug Dupixent developed by Sanofi has grown rapidly, with sales of 3.5 billion euros in 2020, market penetration of approximately 6%, and an estimated peak value of 10 billion euros. In the first clinical trial, the clinical efficacy of FB825 was shown to be comparable to Dupixent. It is further seen in the biomarker study that the efficacy of the population that meets the biomarker is even better than that of Dupixent. Since biologics will continue to dominate the AD market in the future, it is expected that FB825, which has a unique mechanism of action, will have the greatest potential to surpass and replace Dupixent.

How do you reduce the medical burden with Fespixon? Can you make further elaboration?

Given that the unit price of Fespixon in Taiwan is NT$9,800/tube, while the Phase III clinical trial results also suggest that approximately 2-7 tubes of Fespixon cream are required for patients with a wound of 2-10cm2, it can be converted that the daily drug cost per patient is approximately NT$300 - NT$850 per day. After Fespixon hits the market, the physicians are no longer subject to the strict restrictions posed by Phase III clinical trials (where many treatments are excluded). Therefore, they are able to combine it with other active treatments (such as a cardiovascular catheter, coronary artery bypass surgery, and hyperbaric oxygen therapy (HBOT), etc.) It is expected that the patient can achieve complete wound closure sooner after using Fespixon, and the actual dosage and medical burden on the patient will be lessened. In conclusion, whether it is based on Phase III clinical data or post-marketing real-world estimates, compared with NT$141,000, the average annual medical expenditure of Taiwanese DFU patients analyzed by Diabetes Care 2020, it is estimated that Fespixon can reduce the medical burden of patients by more than 50%.

What are the marketing channels of Fespixon? Are they produced by the company itself? Will you find other partners to collaborate with for product marketing?

1. As a prescription drug that requires a prescription, Fespixon can be prescribed by a physician at the hospital or a clinic after launched on the market for sale. From raw materials to finished product manufacturing, the drug supply is completely controlled by Oneness Biotech, including drug quality and production cost control.

2. Although the market in Taiwan is rather small, it is a good starting point to get everything ready. As a global innovative drug, Fespixon will have a global monopolistic status by 2040. If Oneness Biotech chooses not to sell the drugs on its own, the international licensing will only be restricted by others in the future. At present, Oneness Biotech has the ability to control product sales in the market of Taiwan. For markets outside of Taiwan, we are currently negotiating with some international pharmaceutical companies on the cooperation of product sales.

Will Fespixon be sold by the company or sold by Microbio on behalf of the company in the market of Taiwan? Or will it be licensed in accordance with the original plan?

1. Since there is little incentive for the international pharmaceutical company to access the market in Taiwan, the value of “Fespixon” is not only in the drug permit license acquired in Taiwan but also the value generated thereafter, which include (1) New DFU drugs that went through rigorous scientific tests and met relevant laws and regulations (with new drug review in Taiwan meeting international standards); (2) International markets where Taiwan CPP can be launched for sale (3) Continuous extension of international marketing test; and (4) Exclusivity of the new drug “Fespixon” in the global market.

2. At present, Oneness Biotech has activated: (1) priority plan for launching new drug globally; (2) Phase III clinical trial, Fast Track Designation, and the quick access to the US market, an advanced country with the largest market demand for DFU treatment; (3) Simultaneously applying to the advanced countries for the new formulation of medical devices and diversified marketing channels; (4) Initiating several clinical trials in cooperation with the clinical physicians to expand indications and submit papers to the international journals.

3. Since negotiation relies heavily on the strength of the negotiators, Oneness Biotech couldn’t randomly sign licensing agreements with any international pharmaceutical companies with the use of drug permit licenses acquired in Taiwan alone (just because we wouldn’t, doesn’t mean we couldn’t). Oneness Biotech is also fully capable of selling new “Fespixon” drugs in Taiwan, even better than the Taiwan branch of an international pharmaceutical company (it doesn’t necessarily sell by ourselves). What Oneness Biotech should do right now is to accelerate the development of our strength, increase the global value of “Fespixon”, and then negotiating over international licensing.

4. In order to protect the shareholder’s equity of Oneness Biotech, we will not disclose any matters related to the negotiation of licensing, neither will we respond to similar questions about licensing in the future.

Will Fespixon be sold in the market of Taiwan at self expense or under the coverage of national health insurance? What is the market penetration rate of your company’s target market?

1. Self expense is required for Fespixon at the first stage of market access while the cost will be covered by national health insurance in the second stage. At present, the application of drug price under the coverage of national health insurance will be filed after the pharmacoeconomics analysis is completed. And there is a six-month review period after the application is filed.

2. Based on the results of Phase III clinical trials, the clinical treatment effect of Fespixon is extremely significant (P=0.0001) and the time to complete wound closure is significantly shorter than the dressing of the positive control group. After launched on the market for sale, Fespixon can be used to help DFU patients improve their current status of medical treatment. With regard to market penetration, since there is a clear treatment advantage of Fespixon while the pricing survey conducted in Taiwan also shows that Fespixon pricing can be accepted by the vast majority of patients, we are confident that we will work towards the goal of more than 80% market share in the future.

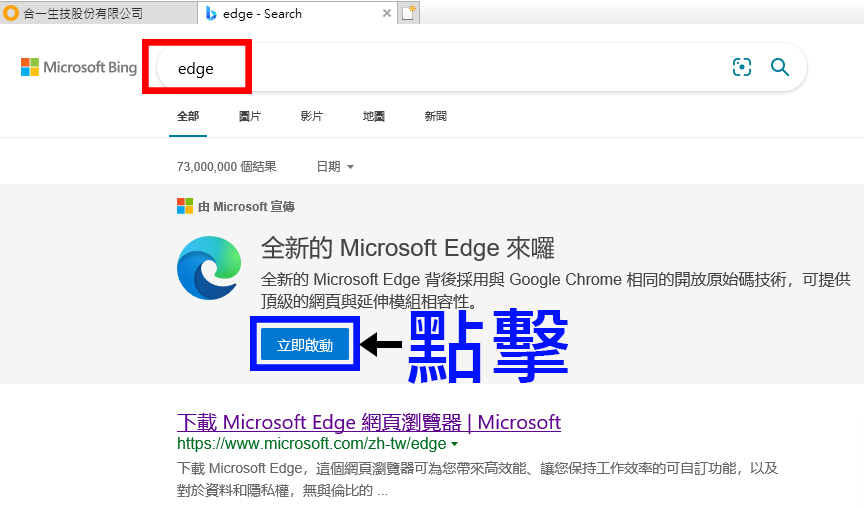

建議您使用以下瀏覽器觀看合一網站,

以獲得最佳瀏覽效果。

如何使用IE找到Microsoft Edge?